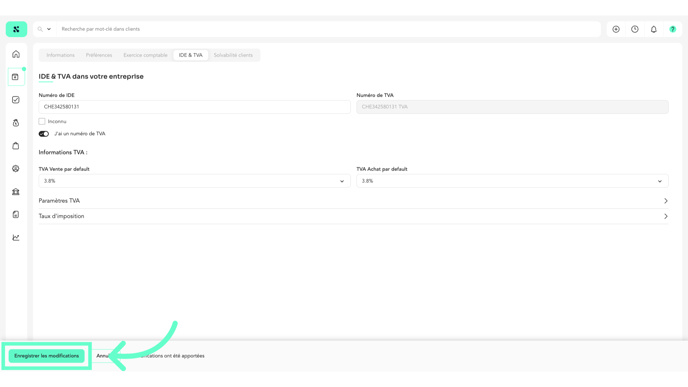

How can I change my company's VAT settings?

Left Navigation Bar > Username > My Company > IDE & TVA

In the "My Company" section, you can modify VAT settings, such as VAT modes and reporting methods.

- Click on your name.

- Then, click on "My Company."

- Navigate to the "VAT & UID" tab.

- The option "I have a VAT number" must be enabled.

- Here, you can select the default VAT rate for your sales and purchase invoices.

To Modify VAT Modes and Reporting Methods

- Click on "VAT Settings."

- Click "Edit" to allow modifications.

- To add a fiscal period, select "Add New" in the fiscal period selector. (Only next year's fiscal periods can be added.)

- In this section, you can modify the VAT mode and reporting method, as long as no accounting entries have been created in that fiscal period.

- If you select Net Tax Liability, you must indicate the corresponding rate.

- Finalize and save the changes to apply your new VAT configurations.

To modify accounting year dates, see the article How can I change the configuration of the financial year ?